Energy Market Report

Dec 23, 2025Recent Developments in Today’s Market

Bullish – Bearish statement provided by AEP Energy Trading

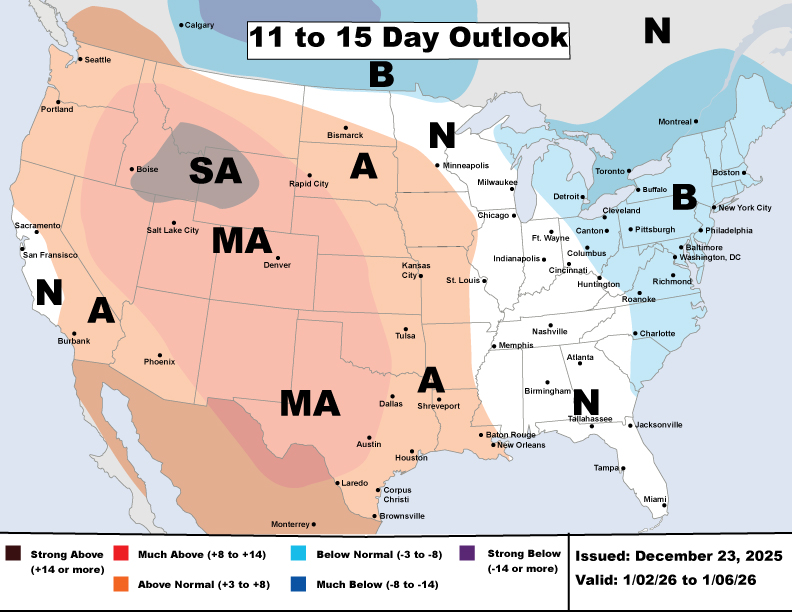

Monday December 22 – Weekend weather models added a bit of demand, but overall, they continue to show a generally warm pattern through the 11-15-day period. Temperatures in Texas remain unseasonably warm for much of the next two weeks, and as a result, power prices are moving lower today.

Friday December 19 – Natural gas moved higher today, closing back above four dollars. Power prices were mostly steady heading into the weekend. With temperatures expected to reach the upper-70s across much of Texas over the next two weeks, power prices declined again, even as the January natural gas contract ended the day more than 7 cents higher.

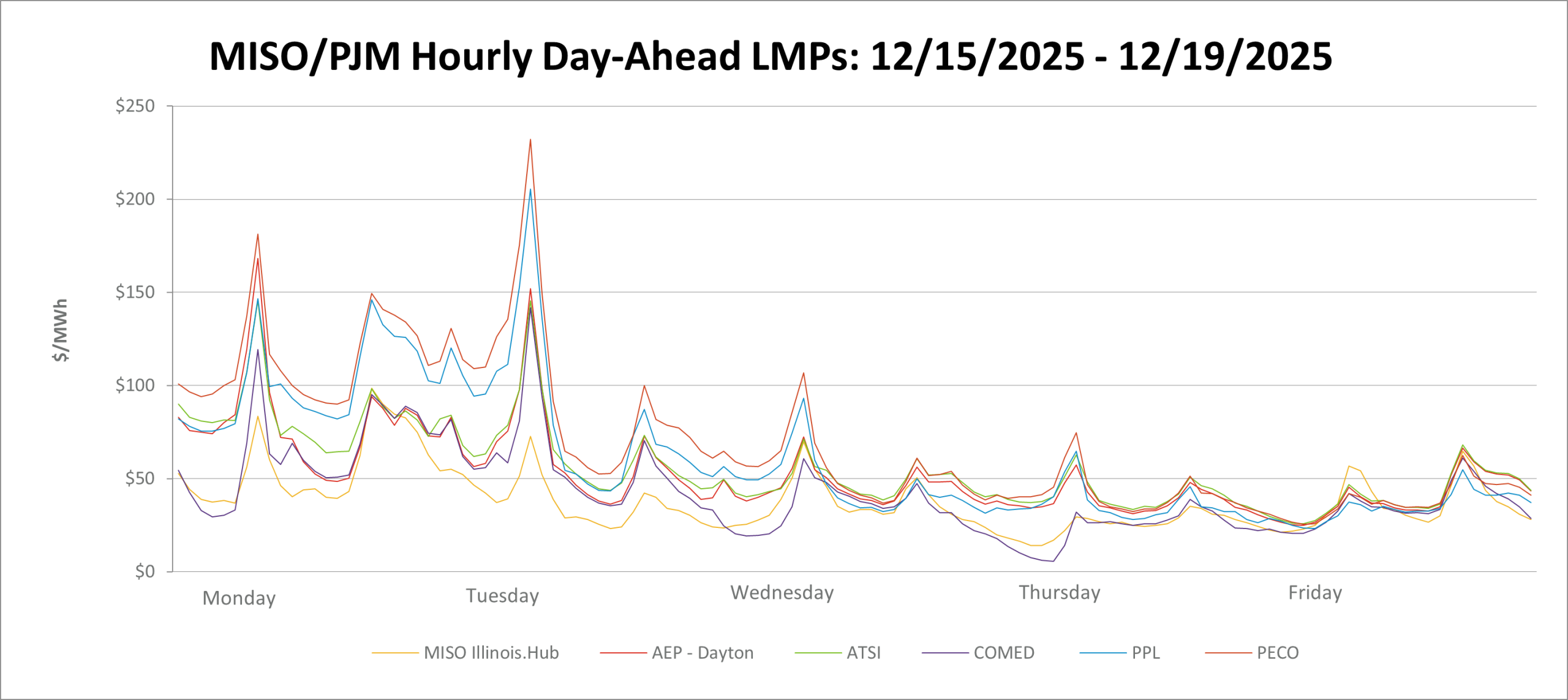

MISO/PJM Hourly Day-Ahead LMP

Source: LMP data courtesy of MISO and PJM; used with permission

*Graphs are for illustrative purposes only; LMPs priced in Central Prevailing Time (CPT)

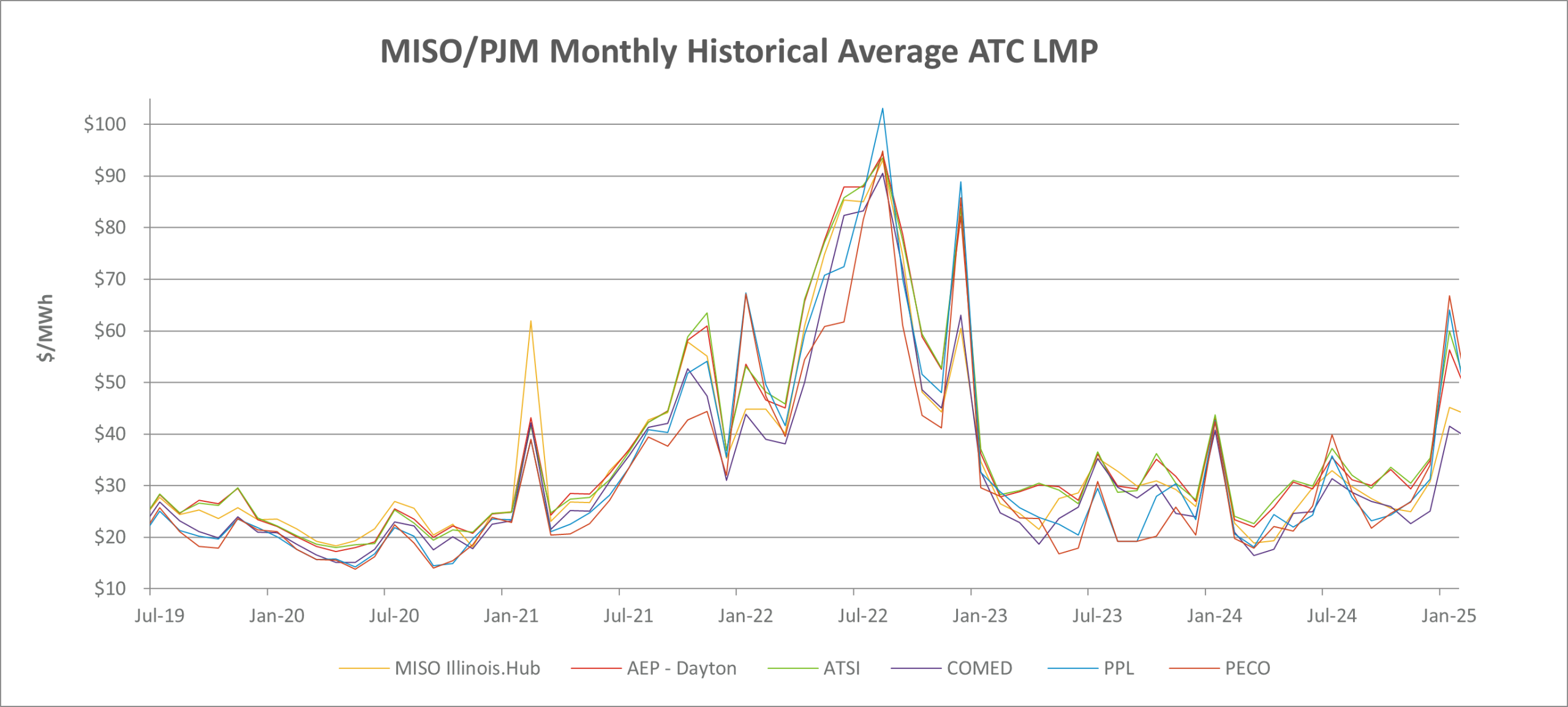

MISO/PJM Monthly Historical Around-the-Clock (ATC) LMP

Source: LMP data courtesy of MISO and PJM; used with permission

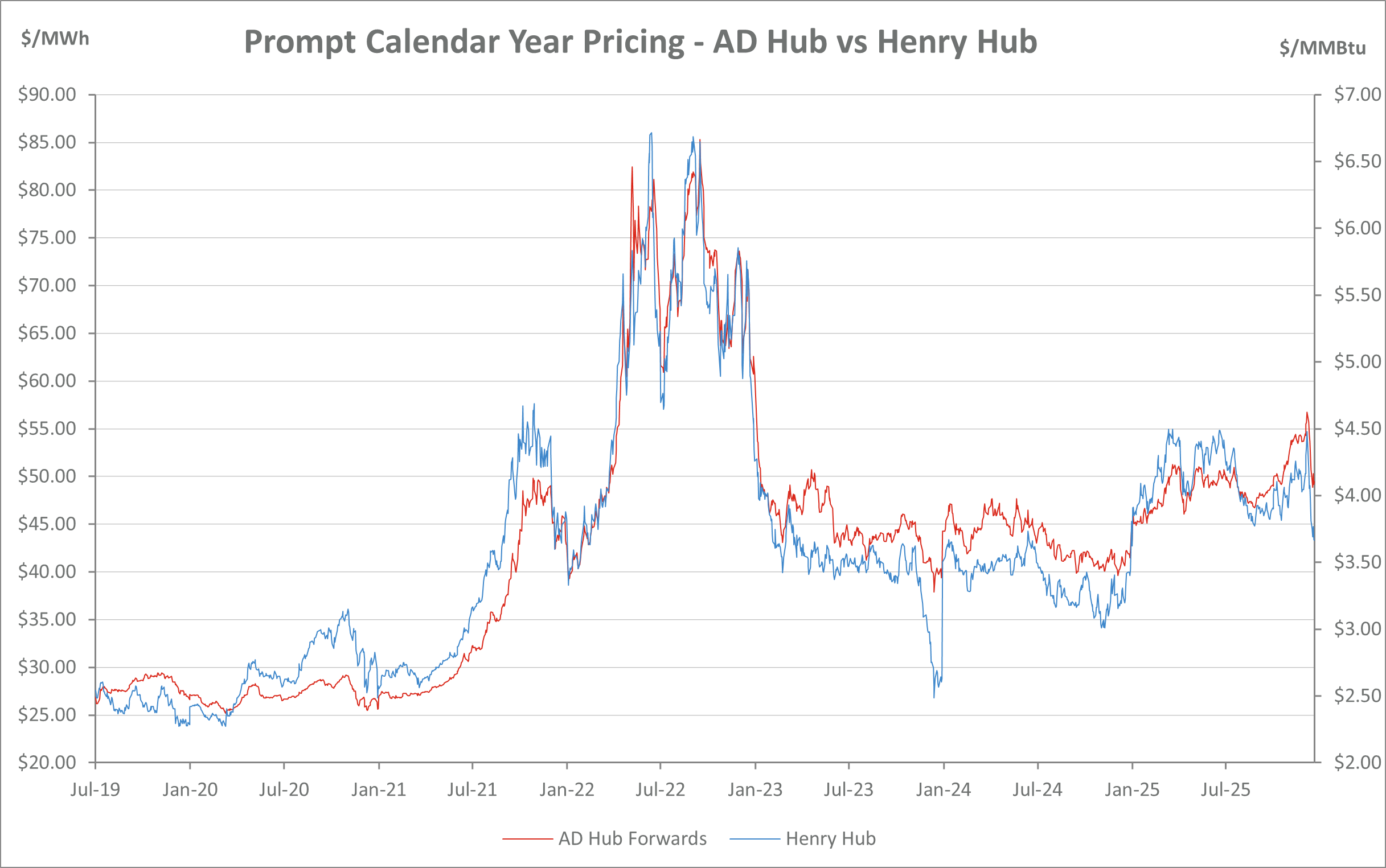

AD Hub Electricity vs. Henry Hub Natural Prices

Source: AEP Energy internal estimates

*Graph is for illustrative purposes only; AD Hub priced in Eastern Standard Time (EST)

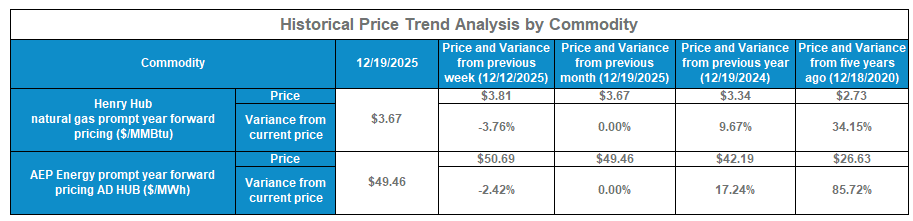

Historic Trend Analysis by Commodity

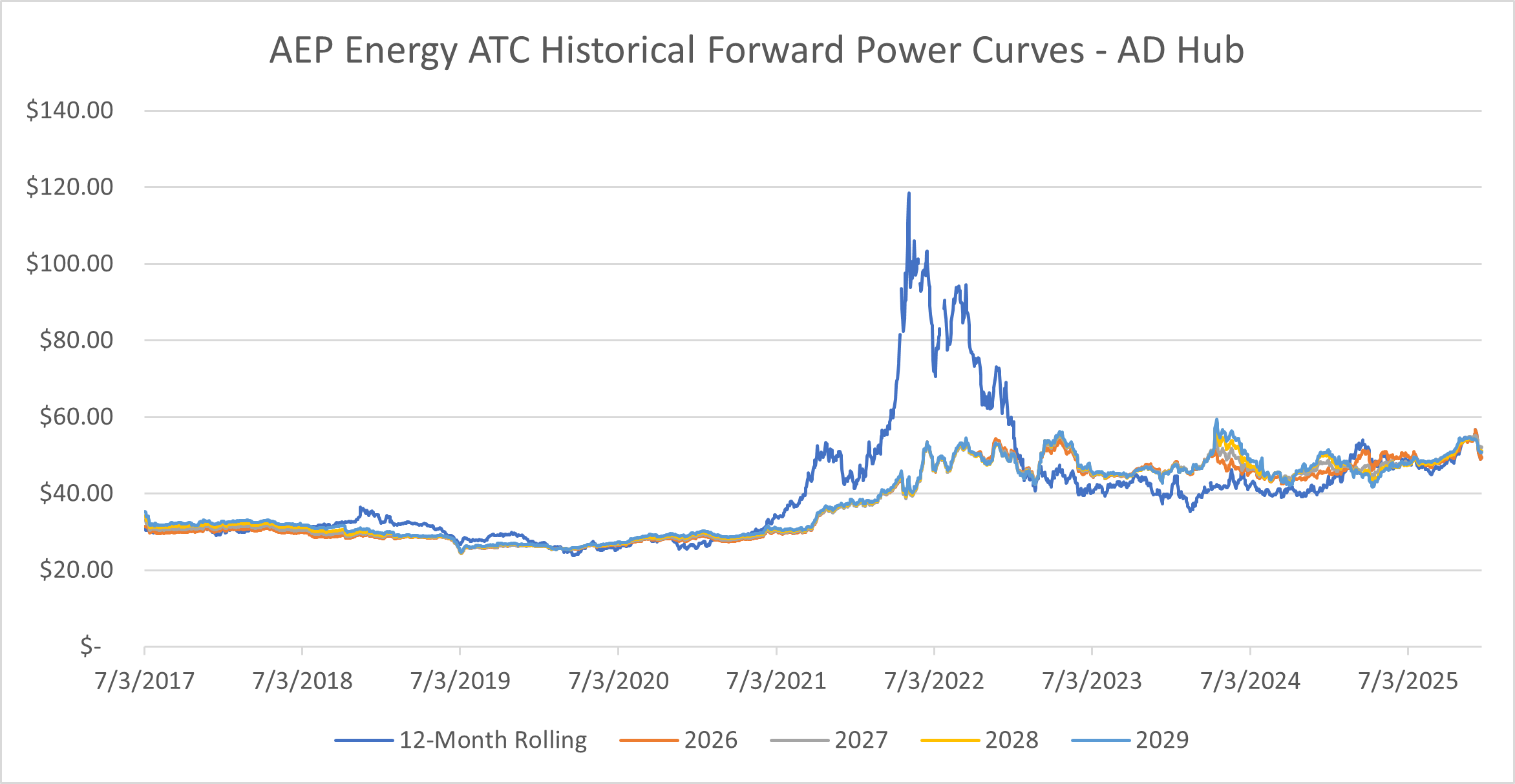

AEP – DAYTON (AD) Hub Around-the-Clock (ATC)

Source: AEP Energy internal estimates

*Graph is for illustrative purposes only. AD Hub priced in Eastern Standard Time (EST)

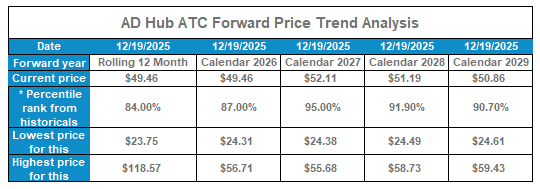

AD Hub ATC Forward Price Trend Analysis

*Percentile rank from historicals represents the relation of current price and how it compares to historical pricing. For Calendar 2027, 95.0% indicates that the current price is lower than 5.0% of historical pricing dating back to July 2017.

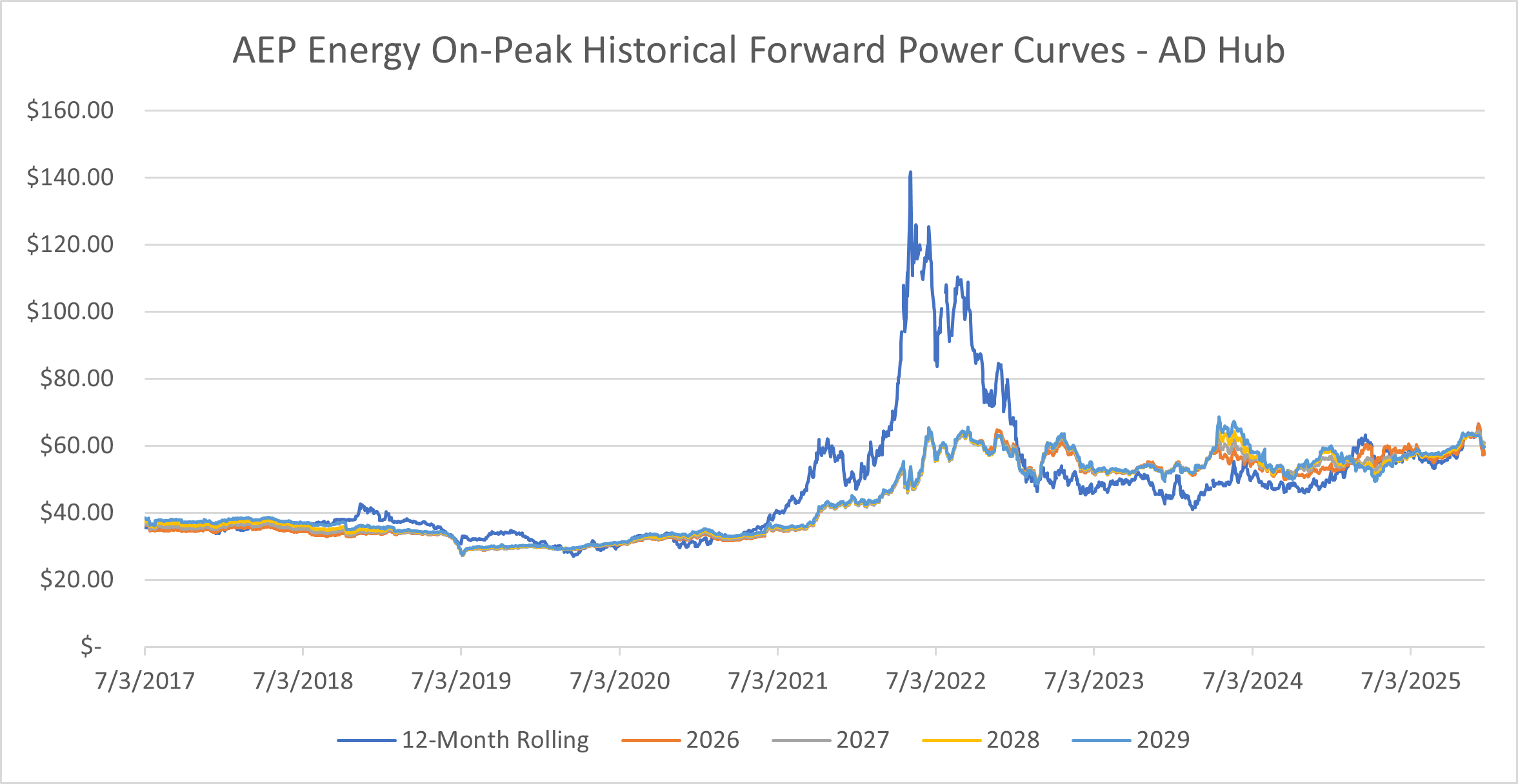

AEP – DAYTON (AD) Hub On-Peak

Source: AEP Energy internal estimates

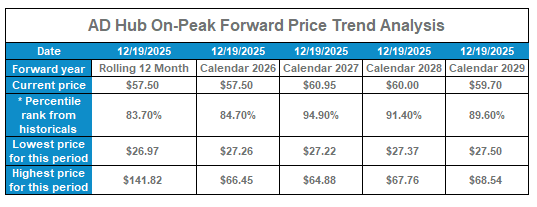

AD Hub On-Peak Forward Price Trend Analysis

*Percentile rank from historicals represents the relation of current price and how it compares to historical pricing. For Calendar 2027, 94.9% indicates that the current price is lower than 5.1% of historical pricing dating back to July 2017.

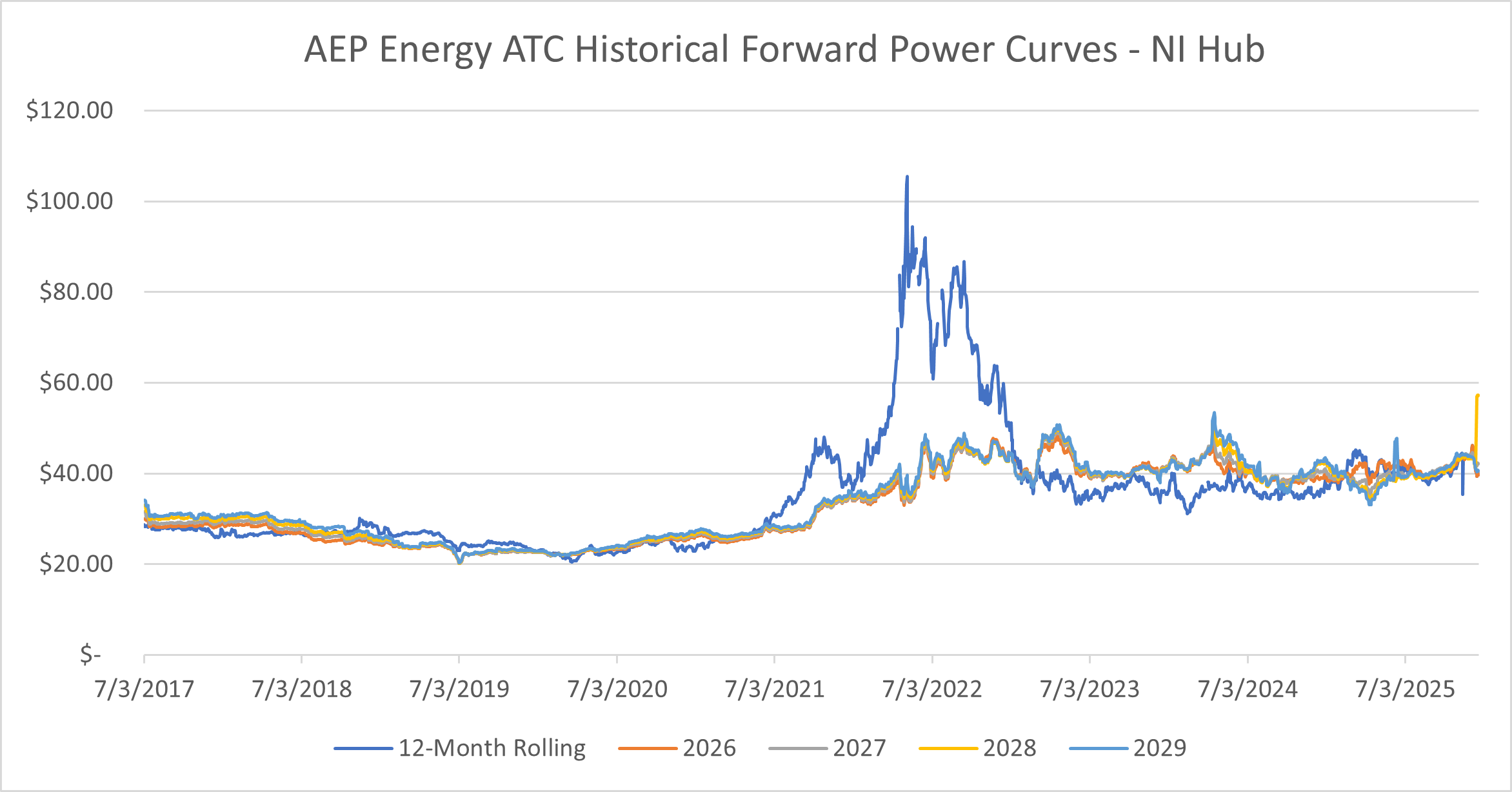

Northern Illinois (NI) Hub Around-the-Clock (ATC)

Source: AEP Energy internal estimates

*Graph is for illustrative purposes only. NI Hub priced in Eastern Standard Time (EST)

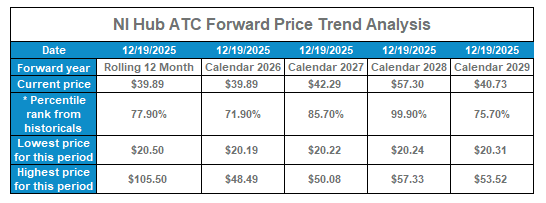

NI Hub ATC Forward Price Trend Analysis

*Percentile rank from historicals represents the relation of current price and how it compares to historical pricing. For Calendar 2027, 85.7% indicates that the current price is lower than 14.3% of historical pricing dating back to July 2017.

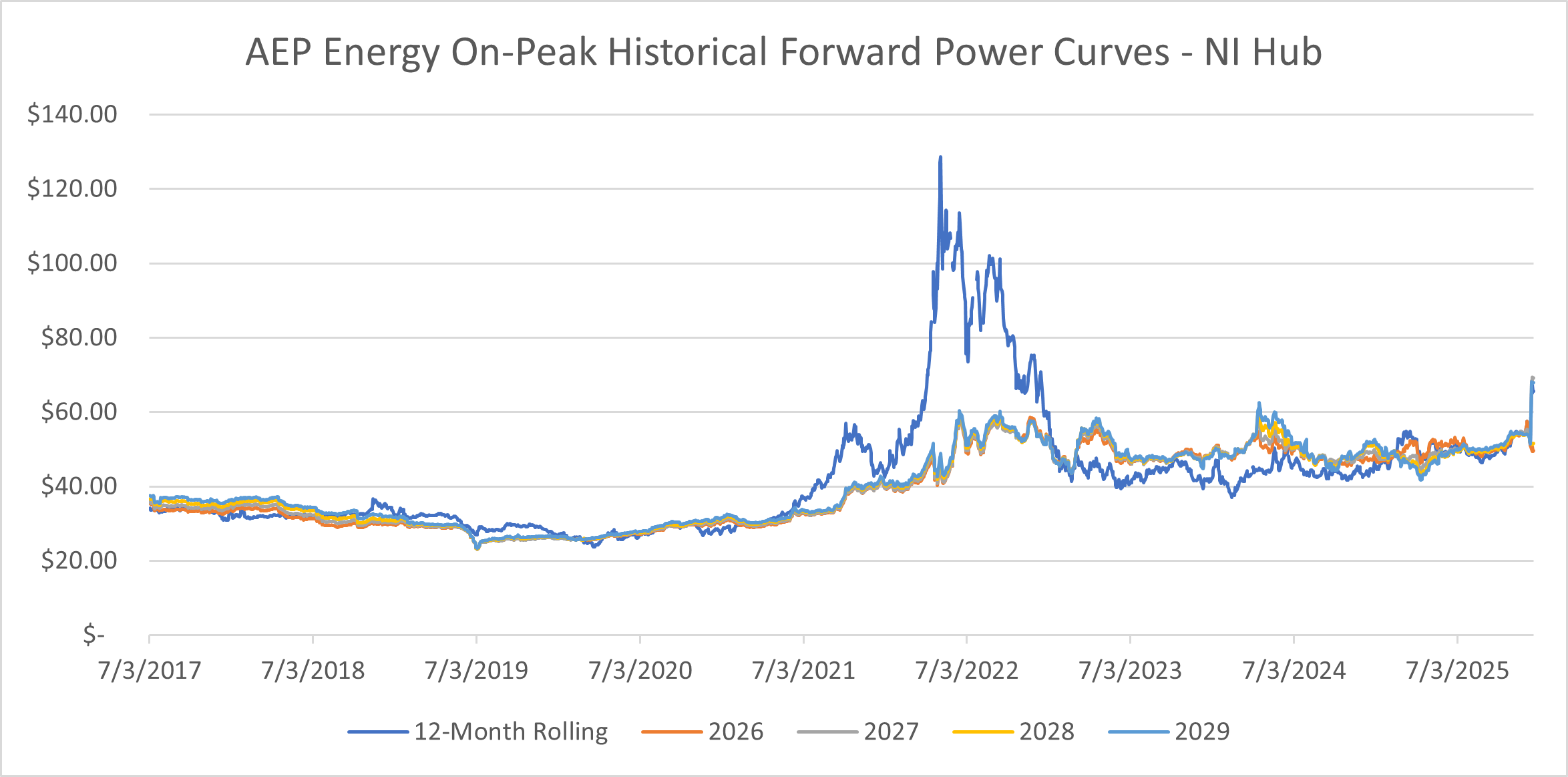

Northern Illinois (NI) Hub On-Peak

Source: AEP Energy internal estimates

*Graph is for illustrative purposes only. NI Hub priced in Eastern Standard Time (EST)

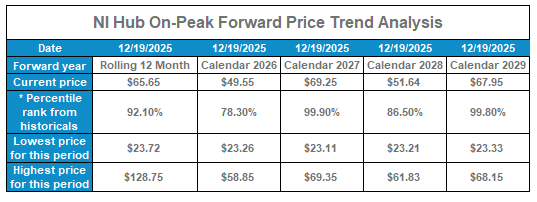

NI Hub On-Peak Forward Price Trend Analysis

*Percentile rank from historicals represents the relation of current price and how it compares to historical pricing. For Calendar 2027, 99.9% indicates that the current price is lower than 0.1% of historical pricing dating back to July 2017.

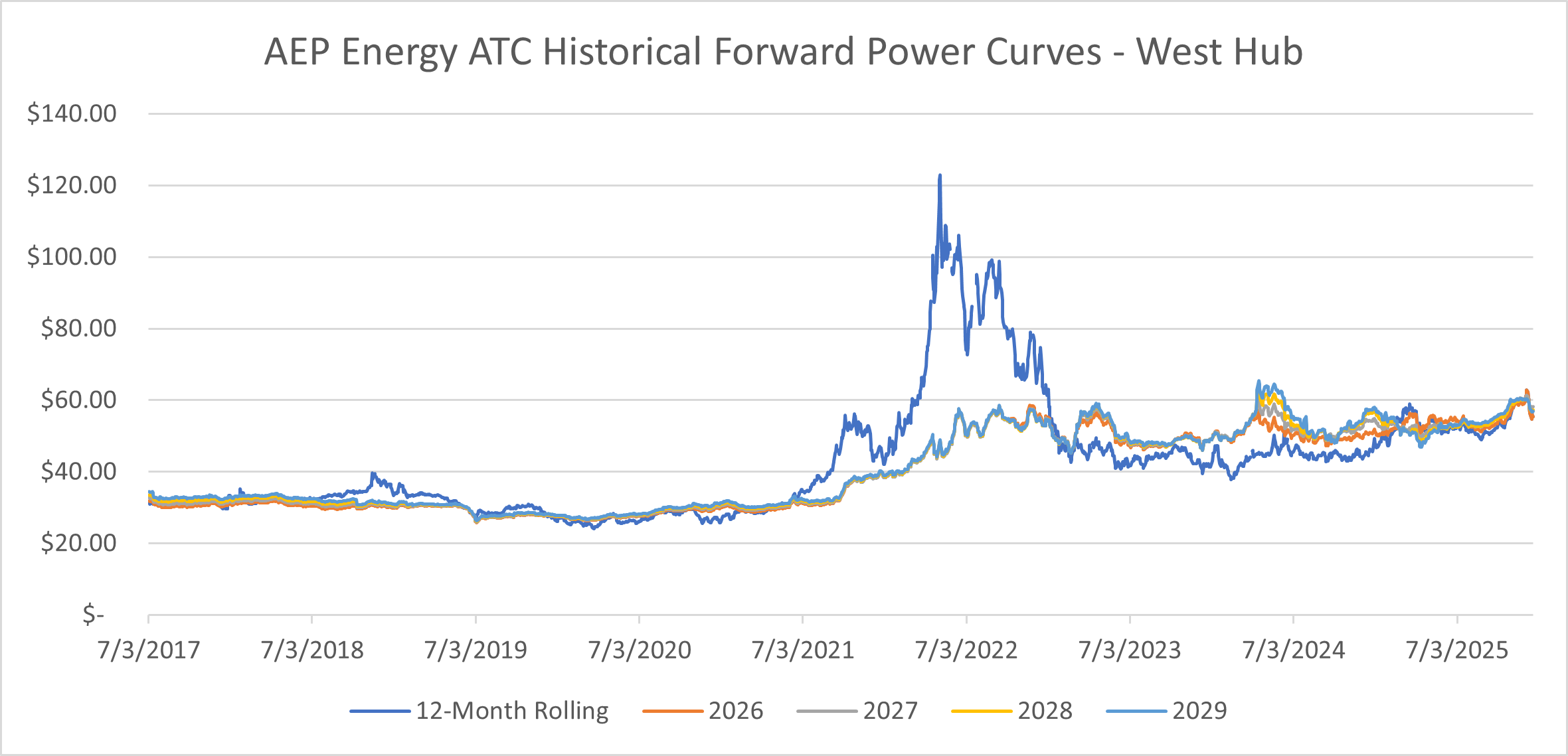

Western (West) Hub Around-the-Clock (ATC)

Source: AEP Energy internal estimates

*Graph is for illustrative purposes only. West Hub priced in Eastern Standard Time (EST)

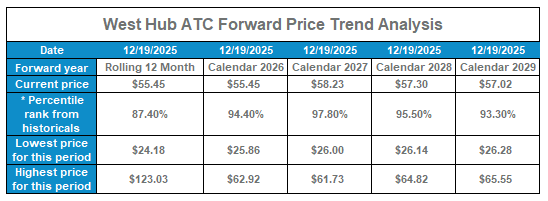

West Hub ATC Forward Price Trend Analysis

*Percentile rank from historicals represents the relation of current price and how it compares to historical pricing. For Calendar 2027, 97.8% indicates that the current price is lower than 2.2% of historical pricing dating back to July 2017.

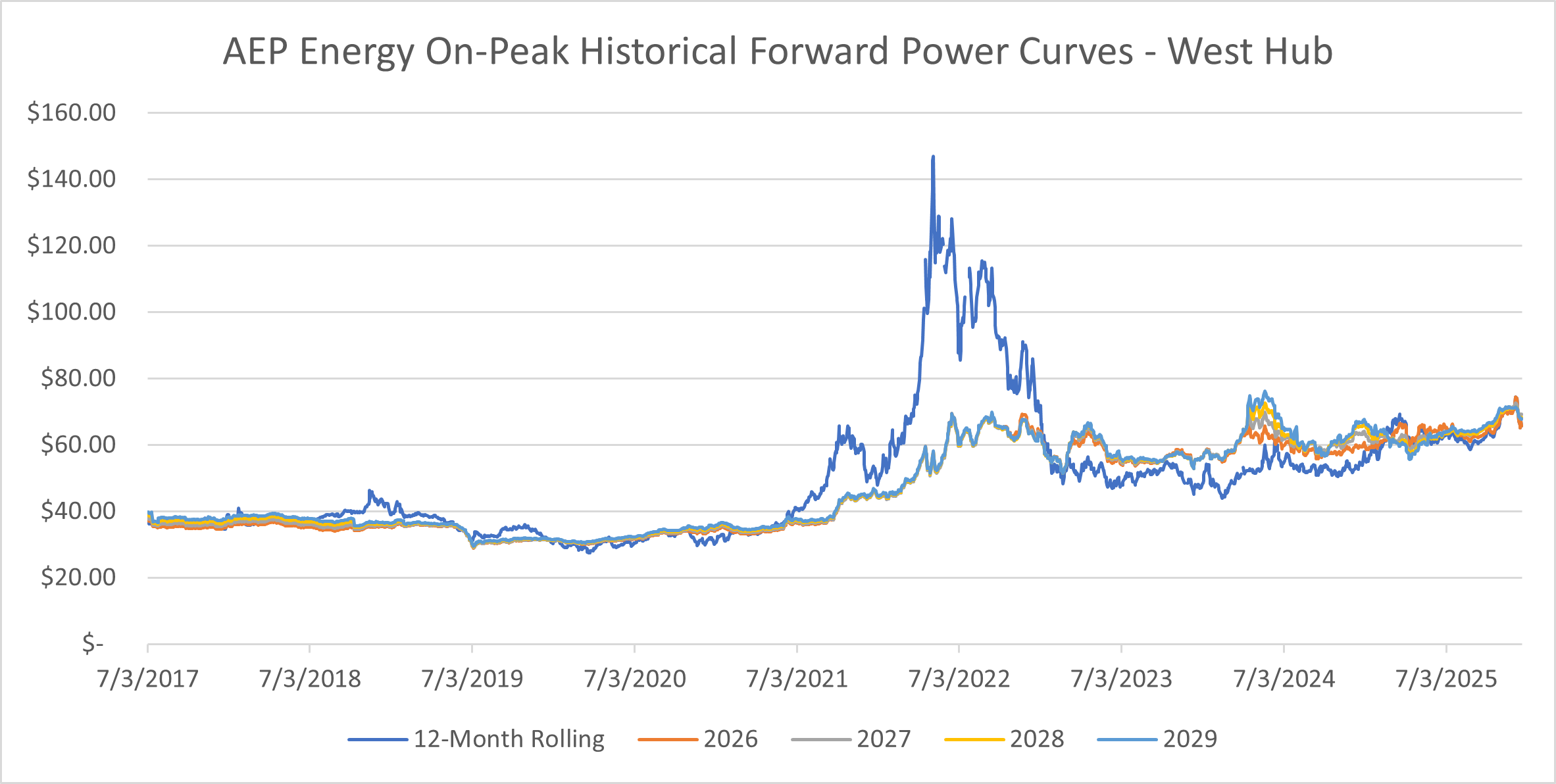

Western (West) Hub On-Peak

Source: AEP Energy internal estimates

*Graph is for illustrative purposes only. West Hub priced in Eastern Standard Time (EST)

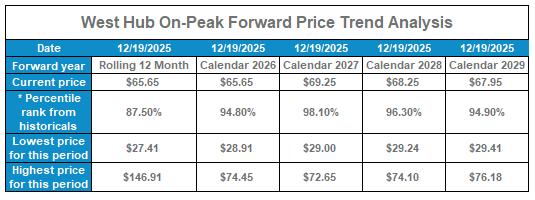

West Hub On-Peak Forward Price Trend Analysis

*Percentile rank from historicals represents the relation of current price and how it compares to historical pricing. For Calendar 2027, 98.1% indicates that the current price is lower than 1.9% of historical pricing dating back to July 2017.

Weather

Source: AEP Energy Supply Meteorologist

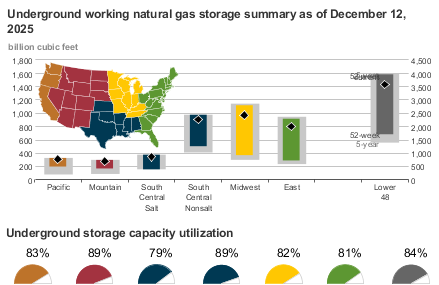

Natural Gas Storage

Source: U.S. Energy Information Administration (EIA)

EIA Natural Gas Storage

Working gas in storage was 3,579 Bcf as of Friday, December 12, 2025, according to EIA estimates. This represents a net decrease of 167 Bcf from the previous week. Stocks were 61 Bcf less than last year at this time and 32 Bcf above the five-year average of 3,547 Bcf. At 3,579 Bcf, total working gas is within the five-year historical range.

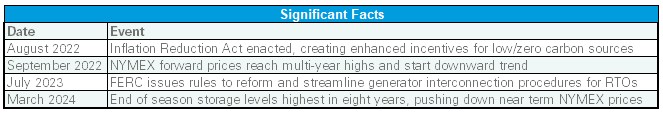

Significant Facts

AEP Energy does not guarantee the accuracy, timeliness, suitability, completeness, freedom from error, or value of any information herein. The information presented is provided “as is”, “as available”, and for informational purposes only, speaks only to events or circumstances on or before the date it is presented, and should not be construed as advice, a recommendation, or a guarantee of future results. AEP Energy disclaims any and all liabilities and warranties related hereto, including any obligation to update or correct the information herein. Summaries and website links included herein (collectively, “Links”) are not under AEP Energy’s control and are provided for reference only and not for commercial purposes. AEP Energy does not endorse or approve of the Links or related information and does not provide any warranty of any kind or nature related thereto. Forward-looking statements contained herein are based on forecasted or outlook information (including assumptions and estimations) but any such statements may be influenced by innumerable factors that could cause actual outcomes and results to be materially different from those anticipated. As such, these statements are subject to risks, uncertainties, fluctuating market conditions, and other factors that may cause actual results to differ materially from expectations and should not be relied upon. Whether or how the customer utilizes any such information is entirely its responsibility (for which it assumes the entire risk).